Plan performance

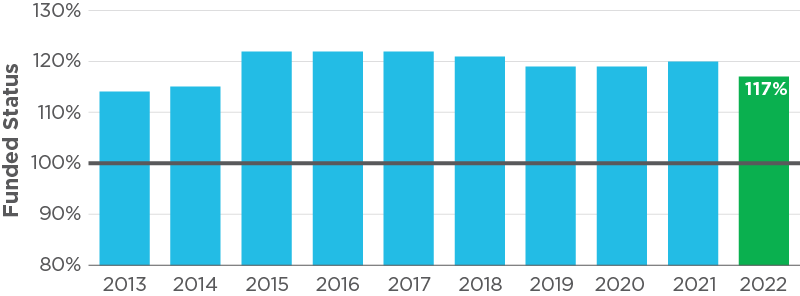

Funded status

117%

A key indicator of a pension plan's health is the ratio of the Plan's assets to its regulatory pension obligations. The Plan's assets are smoothed over five years to minimize the impact of short-term market volatility.

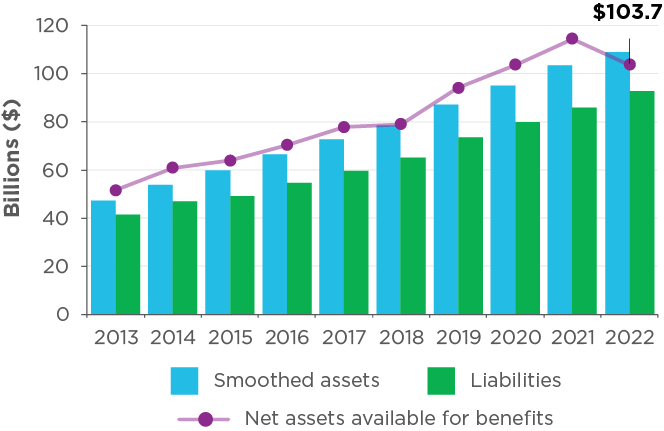

Net assets

$103.7

billionNet assets available to pay pensions, or the difference between the Plan's assets and liabilities.

2022 investment return: -8.60%

10-year annualized rate of return: 8.35%

All figures reported in this document are as at Dec. 31, 2022.

More information about these results can be found on the Plan Performance page of hoopp.com.

The Plan remained fully funded with more assets than it owes in current and future pensions. HOOPP’s funded status has consistently exceeded 100% since 2009.

HOOPP’s strong funded status

Pension peace of mind

Being a member of HOOPP means having confidence that the pension you have earned will be there for you when you need it. Here’s why:

- Your pension is based on a formula. It is calculated using your earnings and years of service in the Plan, so you don't need to worry about market volatility.

- Your pension is secure. When you’re ready to retire, your pension will be there for you.

- You will not outlive your pension. Once you start receiving your pension, you will receive a predictable retirement income for the rest of your life.

Investments

In 2022, we faced a unique environment with historic declines in fixed-income and public equity markets. This had a significant impact on our portfolios, particularly our bond holdings, and led to our first negative annual return since 2008.

While it was a challenging year, our Liability Driven Investing (LDI) approach has served our members very well for many years and we believe it will continue to do so. Our LDI approach is a long-term strategy that focuses on Plan assets in relation to liabilities (in other words, the pensions owed to members). This approach focuses on ensuring that the long-term growth of our investment portfolio meets or exceeds the growth in our pension obligation to members.

Assets have consistently exceeded liabilities

We continue to take a dynamic approach to LDI, adapting our investment activities based on our outlook and shifting economic environment.

Sustainable investing

We remain firmly committed to our sustainable investing strategy, including our pledge to achieve net-zero carbon emissions in our portfolio by 2050. In 2023, we released our climate change plan, which sets out interim targets to reach this commitment while continuing to deliver on our pension promise. These targets:

- encourage companies to adopt transition plans to reduce greenhouse gases

- increase the capital available for green investments

- prioritize real-world emissions reductions rather than selling assets to reduce our portfolio carbon footprint

You can learn more about how HOOPP is managing climate risk and investing in climate opportunities by reading our climate change strategy, available on hoopp.com.

Members and employers

Total number of members:

439,630

267,610

Active

125,967

Retired

46,053

Deferred

Total number of employers:

646

183

Small healthcare organizations

141

Hospitals

90

Service providers

89

Family health teams

76

Foundations

67

Community health centres

The ongoing strength of the Plan made it possible to improve benefits and provide additional support for members. In 2022, our Board took steps to:

- increase pensions for active members through a benefit improvement; this builds on previous enhancements approved by the Board in 2018 and 2021

- help pensions keep up with rising prices by providing retired and deferred members with cost-of-living adjustments of 4.8%, effective April 1, 2022, and 6.3%, effective April 1, 2023

- keep the Plan affordable for members and employers by keeping contribution rates unchanged until at least 2024

We also continued to expand the pension education and digital services we provide for members. This included:

- redesigned annual statements for active and deferred members that highlight the most important information in a more modern and easy-to-read design

- new and improved retirement planning resources on hoopp.com such as the Expert Corner and Planning for Retirement sections

- new online retirement feature on HOOPP Connect that gives members a convenient new way to choose their retirement options and submit banking information securely

- option to make electronic payments for buybacks and transfers to help members simply and conveniently maximize their pension

We want to hear from you!

Let us know what you think of our 2022 Highlights by completing a short survey. You’ll be entered into a draw for a chance to win a Dyson V8 Absolute cordless vacuum.

Thank you and good luck!

For more information on all our results, view our 2022 Annual Report.

Before you go – are you registered for HOOPP Connect?

As a HOOPP member, getting connected to your pension offers many benefits. HOOPP Connect is your one-stop online pension resource. With HOOPP Connect, you can:

- explore different retirement scenarios using various ages, dates, and salaries

- access your pension details and documents – online and all in one place

- update your contact and beneficiary information conveniently

- communicate with HOOPP and send attachments quickly and easily

Get connected – it's easier than you think.

First-time users: Register here