Early Retirement Benefits

Early Retirement Benefits

With a HOOPP pension, you have the option to retire as early as age 55.

If you retire before you reach either age 60 or 30 years of eligibility service (whichever comes first), you will receive an adjusted pension to reflect the fact that you will probably receive it for a longer period.

If you retire before age 65, you will receive a monthly bridge benefit in addition to your retirement pension.

The date you choose to retire can impact your overall HOOPP pension amount, with factors like your age, eligibility service and other considerations playing a role. Learn more about what you should consider when you are deciding when to retire.

What is the bridge benefit?

If you retire between the age of 55 and 65, you’ll receive a temporary bridge benefit, which is a temporary monthly benefit payable in addition to your lifetime pension if you retire early. Any bridge benefit will continue to be paid until age 65

or when you pass away – whichever happens first – and does not stop if you take your CPP early. The bridge benefit is not payable if you are receiving a HOOPP disability pension.

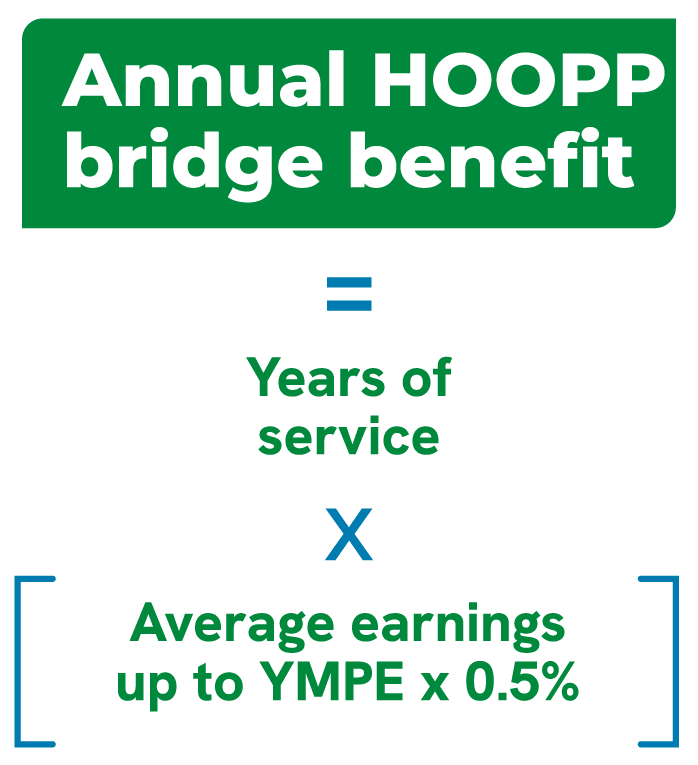

The bridge benefit formula

Benefit improvements and your bridge benefit

For the years that you are eligible to receive a benefit improvement, there will be an adjustment to your bridge benefit. This means that, if you retire early, you will see less of a change to your monthly payments when the bridge benefit ends because

your lifetime pension is higher. As a result, the bridge benefit may play a smaller role in your decision of when to retire.

Learn more about benefit improvements.

Find out what your pension could look like

With the Pension Estimator on HOOPP Connect, you can get a personalized estimate of what your future pension could look like at key milestone dates, and how it can change based on different factors and possibilities, such as:

- retiring early or later

- changing your future work schedule (e.g. from full time to part time or vice versa)

- any future salary increases.

Plus, you can save and compare different retirement ages and scenarios to come back to later.

Visit HOOPP Connect

When can I retire?

As a HOOPP member, you have the flexibility to start receiving your lifetime pension as early as age 55, as late as age 71, or anywhere in between. The choice is yours.

I’m ready to retire. How do I start receiving my pension?

Initiating your retirement is as simple as letting your employer know that you’re ready. Your employer will notify us on your behalf, we’ll take care of the rest! Please make sure to provide your employer with sufficient notice to ensure there is enough time to process your retirement.

Once you’ve told your HOOPP employer you’re ready to retire, you can make your elections online simply and conveniently using the online retirement feature on HOOPP Connect.

Before you can start receiving your pension, you must end your employment at all of your HOOPP employers where you are enrolled and contributing to the Plan.

If you deferred your pension after leaving your HOOPP employer, it is your responsibility to contact HOOPP to notify us of the date you want to start receiving your pension.

This document provides a simplified overview of HOOPP's benefits based on the terms of the HOOPP Plan Text at the time of publication. From time to time, HOOPP may amend the HOOPP Plan Text. In cases where the information provided in this document differs from that contained in the HOOPP Plan Text, the HOOPP Plan Text will govern. More details, including the full HOOPP Plan Text and a complete description of the Plan and its benefits, can be found on hoopp.com.

What can we help you find?