Should Amy remain a HOOPP member?

If Amy keeps her pension with HOOPP, she is eligible to receive a monthly lifetime pension of $1,525 along with a bridge benefit of $75 per month that will be paid until she turns 65.

These amounts could grow with any approved cost of living adjustment (COLA) both before and after retirement. If COLA was provided at an average of 2.0% per year over 15 years, this could increase her lifetime pension to $2,040 per month and her bridge benefit to $100 per month by the time she retires at age 60.

She knows her pension will be a secure source of income, providing her with peace of mind in retirement. Amy knows that many women who retire at age 60 will receive a pension well into their 80’s or beyond. In this scenario, she would receive approximately $791,300 from her HOOPP pension over her lifetime, if

she lives to age 85.

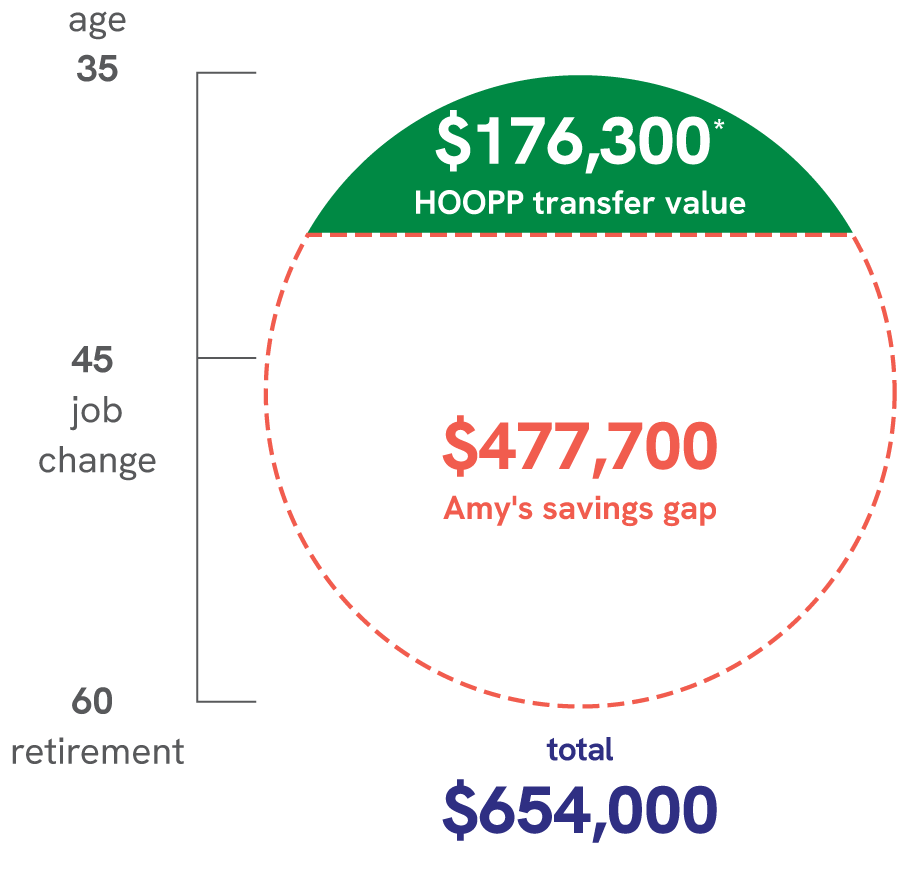

Could Amy transfer the lump sum value of her HOOPP pension into a personal locked-in retirement account (LIRA) and still receive the same monthly income when she retires? It isn’t impossible, but it would be hard to achieve.

Should Amy take her pension out of HOOPP?

If Amy took the approach of investing the funds in a LIRA, and wanted to generate a stable lifetime monthly income in retirement, she would need to save enough to purchase an indexed lifetime annuity, which provides you with income for life, for approximately

$654,000 when she retires at age 60. The commuted value of Amy’s HOOPP pension would be a starting point, but it wouldn’t be enough. To build her savings, Amy would have to take on the responsibilities

and risks that come with investing these funds until she retires. There are no guarantees she would be able to save enough or find an annuity that offers everything her HOOPP pension can provide.

Amy's challenges:

- Being responsible for investment decisions

- Paying commissions and fees

- Finding an annuity with HOOPP-like benefits

- Navigating volatile markets

If Amy saves less than planned, or if she can’t find an annuity that offers equivalent benefits, her retirement will be impacted and she has increased the risk of outliving her savings.

* This represents Amy’s total HOOPP transfer value of $176,300, where the full amount was locked in. Amy would need to invest this amount over 15 years in preparation for retirement.

Amy's decision

After reviewing her options, Amy decides to keep her pension with HOOPP. She knows that her pension is secure and she will collect it for life. She also knows it could continue to grow through COLA, and survivor benefits are provided at no additional cost. She may also be able to combine her deferred pension with any new benefit if she returns to work for another HOOPP employer.

Amy values the peace of mind that comes with a stable, predictable monthly pension – this allows her to plan her budget and her retirement with greater confidence.

With all of the peace of mind her HOOPP pension offers, Amy’s choice is clear.