(Toronto) The Healthcare of Ontario Pension Plan (HOOPP) today announced a rate of return of 17.71% per cent for the year ended December 31, 2014, driving net assets to a record $60.8 billion from $51.6 billion in 2013. Investment income for the year was $9.1 billion, up from $4.0 billion in 2012, and exceeded its portfolio benchmark by 2.1%, or more than $1.0 billion. The 2014 results elevated the Plan’s 10-Year return to 10.27%, and 20-Year return to 9.98%.

HOOPP’s funded position remained stable at 115%, up from 114% in 2013. As a result of the stable funding position, contribution rates made by HOOPP members and their employers have remained at the same level since 2004.

HOOPP President & CEO Jim Keohane attributes the results to the liability driven investing (LDI) approach that the Plan adopted several years ago. “2014 was a year that highlighted the merits of the LDI approach. Sharp declines in interest rates, that were highly beneficial to our fixed income portfolio, offset the negative impact of the rate declines on our pension obligations.”

“Our 295,000 members count on HOOPP to deliver on the pension promise and it’s the foundation of our business plan,” says Keohane. “Being fully funded means we are able to consistently deliver to our members and our liability driven investing approach has been critical to ensuring the long-term health and sustainability of the Plan.”

2014 Return Highlights

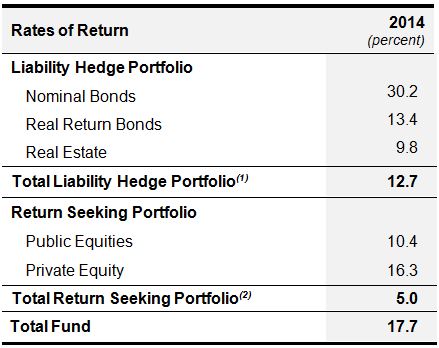

HOOPP’s liability driven investing approach utilizes two investment portfolios: a liability hedge portfolio that seeks to mitigate risks associated with our pension obligations, and a return seeking portfolio designed to earn incremental returns to help to keep contribution rates stable and affordable.

In 2014, the liability hedge portfolio provided approximately 72% of our investment income. Nominal bonds and real return bonds provided most of the income within this portfolio, generating returns of 30.2% and 13.4% respectively. The real estate portfolio was also a contributor during the year, with a 9.8% return.

Within the return seeking portfolio, public equities were the largest contributor to investment income, returning 10.4%. Private equity posted a return of 16.3%.

(1) Returns generated by short-term fixed income assets are included in the total for the liability hedge portfolio but not attributed separately.

(2) Returns generated by other return seeking strategies are included in the total for the return seeking portfolio but not attributed separately.

About the Healthcare of Ontario Pension Plan

Created in 1960, HOOPP is a multi-employer contributory defined benefit plan for Ontario’s hospital and community-based healthcare sector with over 470 participating employers. HOOPP’s 295,000 members and pensioners include nurses, medical technicians, food services staff and housekeeping staff, and many other people who work hard to provide valued Ontario healthcare services.

As a defined benefit plan, HOOPP provides eligible members with a retirement income based on a formula that takes into account a member's earnings history and length of service in the Plan. Once eligible members start receiving a pension, they receive it for life.

HOOPP is governed by a Board of Trustees with representation from the Ontario Hospital Association (OHA) and four unions: the Ontario Nurses' Association (ONA), the Canadian Union of Public Employees (CUPE), the Ontario Public Service Employees' Union (OPSEU), and the Service Employees International Union (SEIU). The unique governance model provides representation from both management and workers in support of the long-term interests of the Plan.

For further information or to arrange interviews, please contact:

newsroom@hoopp.com