Plus tips to help you get ready for tax season

It’s that time of year – tax season! To help you prepare in advance, your 2024 tax slip is available now, on HOOPP Connect.

To find the digital copy of your tax slip, simply log in to HOOPP Connect and follow the steps below. If you don’t yet have a HOOPP Connect account, you can register here.

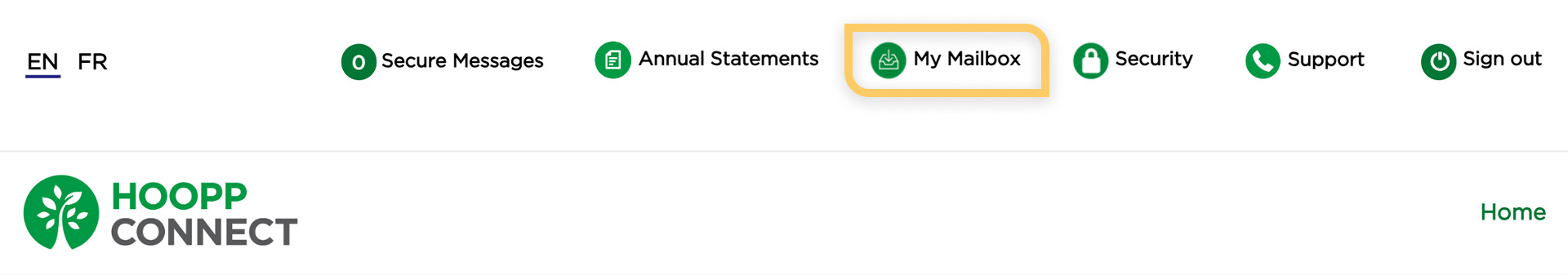

- Sign in and select My Mailbox from the navigation bar at the top of the page.

- Select the Annual statements and tax slips tab and find your tax slip in the list of links below. Click on the link to download, save or print your slip.

Tax considerations for retired members

As we head into tax season, it’s important to understand the broader impact of taxes on your retirement income. The tax considerations below can help you reduce the amount of tax you pay and help you maximize your pension income during retirement.

Income splitting between spouses

For tax purposes, married or common-law couples can allocate up to 50% of their eligible pension income to a spouse in a lower tax bracket. This can help you save on income taxes and may also help you reduce (or avoid) a potential clawback of Old Age Security (OAS) benefits. Your HOOPP pension is eligible for income splitting as early as age 55.

Tax credits

Taking advantage of the tax credits available to you can help you reduce how much tax you pay on your taxable income. Here are some of the credits to consider, depending on your personal situation:

- Pension income tax credit. This credit can be claimed annually when you file your personal tax return or can be used to reduce the amount of taxes you pay upfront each month. You may be able to reduce the amount of taxes being deducted from your monthly pension payment by completing and sending HOOPP a federal TD1 (Personal Tax Credits Return) and your provincial TD1 form.

- Age amount tax credit. If you are age 65 or older and your net income falls below a set level, this tax credit may be available to you.

- Disability tax credit. If you have health conditions that restrict or impair your everyday life, you may qualify for the disability tax credit, which can reduce the amount of income tax that you, or your supporting family member, have to pay.

- Canada caregiver credit. If you support your spouse or other family member with a physical or mental impairment, you may be eligible to claim this credit to help reduce your taxes.

- Medical expenses. You can claim eligible medical expenses that you, your spouse or common-law partner paid for during the tax year.

To find tax credits and other programs that you may be eligible for, the benefit search tools offered for Government of Canada benefits and Ontario benefits and programs are a great place to start.

Remember, CPP is taxable income

It’s important to note that your Canada Pension Plan (CPP) benefits are also taxable income. But taxes are not automatically deducted by the government, and as a result, you could end up owing tax at the end of the year. You can request that Service Canada deduct federal income tax directly from your payments, or you can ask HOOPP to increase the tax applied to your pension by a set amount to account for the additional tax.

We’re here to help

If you have any questions or need help accessing your tax slips on HOOPP Connect, please contact our Member Services team at

416-646-6445 or toll-free at 1-877-43HOOPP (46677), Monday to Friday, 8 a.m. to 5 p.m., Eastern Time.